New Delhi: The Indian Railways, which has been pushing for higher revenue from its freight services, reported record earnings from this segment in the last financial year (2022-23) – about Rs 1.62 lakh crore.

But the bulk of these revenues come from coal, a fossil fuel, raising questions about its sustainability as a source of income as India takes action to combat climate change.

India is working towards achieving net zero emissions – reducing emissions as much as possible, while managing any residual emissions Absorbed From the atmosphere – until 2070.

This will require reducing the country’s overall dependence on coal and moving towards renewable sources of energy.

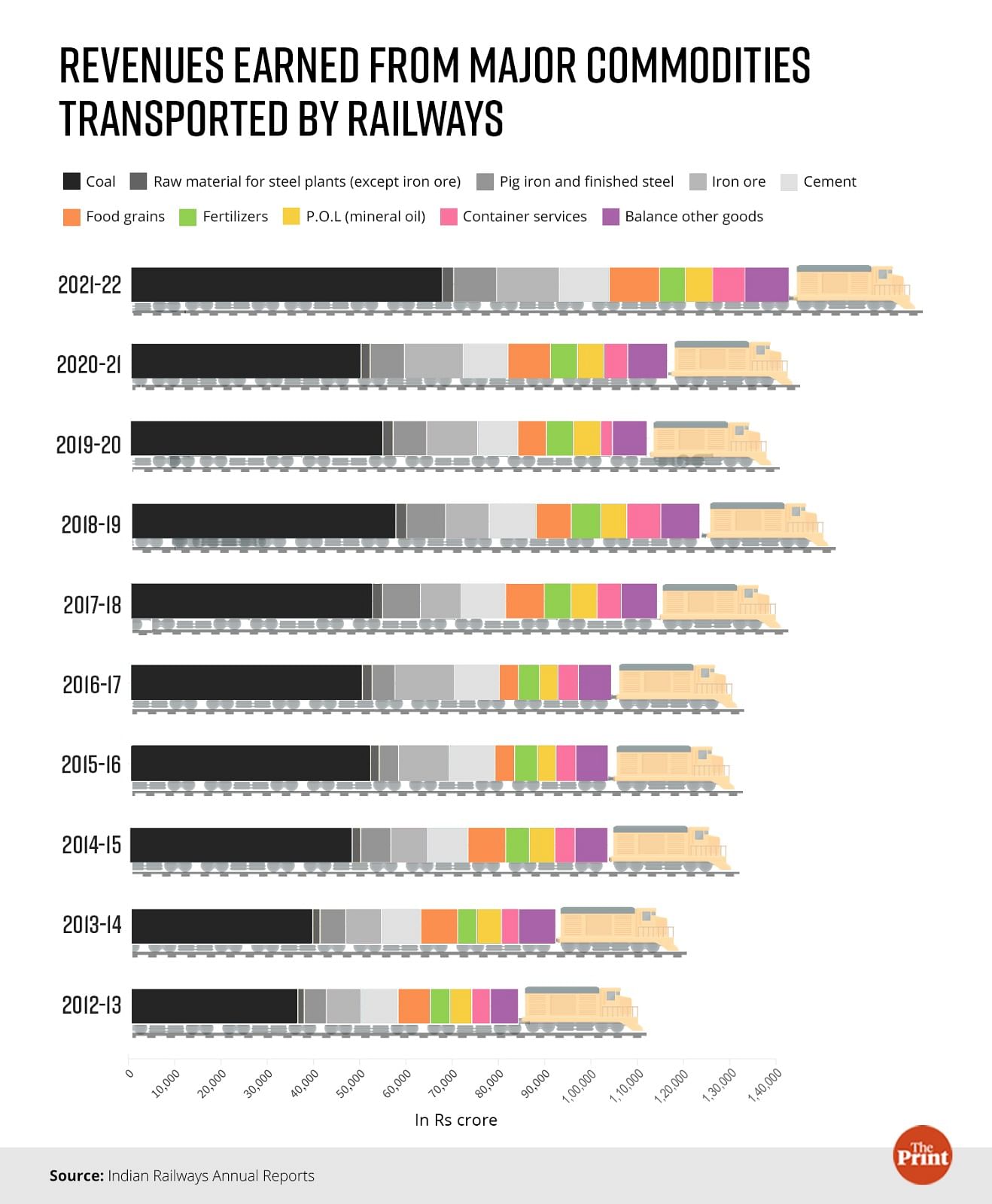

Over a 10-year period from 2012-13 to 2021-22, the contribution of coal to railways’ revenue has increased from 43 per cent to 47 per cent. In absolute terms, out of the total freight revenue of Rs 1.39 lakh crore in 2021-22, Rs 65,856.08 crore was from coal transportation.

Other major contributors to railways’ freight revenue – the transporter’s major source of income – are ‘bulk items’ such as iron and steel, iron ore, food grains, cement, petroleum products and fertilisers.

Bulk goods are those that are not containerized and are directly transported via a ship in large quantities, unlike non-bulk goods, which are often packaged.

Railways data shows that coal is the only major commodity that has seen a significant increase in freight revenue.

The freight revenue of raw materials for steel products was to account for 1.7 per cent in 2021-22 as against 1.65 per cent in 2011-12. The revenue contribution of container services saw a marginal increase, from 4.79 per cent to 4.9 per cent. The contribution of cement fell from 9.5 per cent to 7.6 per cent during this period. Food grains (revenue share decreased from 8.35 percent to 7.6 percent), fertilizers (5 percent to 3.9 percent) and mineral oils (5.6 percent to 4 percent) showed a similar trend.

Railways is trying to increase revenue from other products, including mass consumer durables and non-bulk goods like automobiles. Their contribution to freight revenue in 2021-22 was about 6.6 per cent, which is slightly less than 7 per cent in 2012-13.

In 2022-23, the gross revenue of the Railways was about Rs 2.4 lakh crore, of which Rs 1.62 lakh crore came from freight services and Rs 63,300 crore from the passenger segment.

In a report on railway finances for the financial year ending March 2021, the Comptroller and Auditor General (CAG) pointed out that the transporter relies heavily on coal for its freight services. It added, “Any change in bulk commodities transport pattern can significantly impact railways’ freight earnings.” Despite running various incentive schemes for a long time, the Railways has not been able to diversify its freight traffic.

ThePrint reached the railway spokesperson via call and text for a comment on possible plans to diversify the transporter’s freight portfolio, but did not receive a response till the time of publishing this report.

Experts say that despite the growing emphasis on clean energy, coal will continue to be a major cargo item not only for the railways, but for the overall logistics sector.

coal and railways

Speaking to ThePrint, Jaganarayan Padmanabhan, Senior Director, CRISIL Market Intelligence & Analytics, said, “Freight revenue is a major contributor to the total revenue of the Indian Railways.”

“Over the years the freight business has cross-subsidised the passenger business segment. Hence, in order to maintain a healthy operating ratio, it is imperative that the revenue from this segment does not go down,” he added.

Supriyo Banerjee, Vice President and Sector Head – Corporate Ratings, ICRA Ltd., said that coal is “an important raw material in India for various industries”.

“A major share of coal is imported, and domestic coal mining is concentrated in a few places. However, it is distributed in many parts of the country. Therefore, transportation of coal constitutes a major share in freight moved and continues to be an important cargo for the Railways,” he said.

“However, increasing emphasis on other forms of clean fuels, such as renewable energy, will be at the forefront of capacity addition in the power sector. Given India’s large reliance on thermal as a fuel for power generation, as well as the use of coal for other industries such as steel, cement, etc., coal will continue to be a major cargo for not only railways but the overall logistics sector. ,

A former railway official told ThePrint that the railways has always been dependent on coal for freight.

While the Railways need to diversify and increase the share of revenue from more commodities, “reliance on coal is unlikely to reduce as the country is still dependent on thermal power to meet the growing demand for electricity and it will soon Not expected to change”.

However, Padmanabhan said that, over the next decade, “as the sustainability agenda takes further center stage and moves towards cleaner sources of power generation, this will have a significant impact on the railways’ freight business”.

“There is also a significant inertia factor to changes in the mode of transport among other commodities and it is therefore important that the necessary ecosystem is provided to make the change.”

According to data compiled by the government, a total of 4,523.2 million tonnes of freight was carried across the country in 2018-19.

Of this, 1,221.5 million tonnes – or about 27 per cent – were moved by rail. The majority – 2,911.7 million tonnes or 64 percent – was transported by road. Other sources of transportation include coastal shipping (5 percent), inland waterways (2 percent), and pipelines (2 percent).

Railways has prepared the ‘National Rail Plan (NRP) for India – 2030’, which aims to increase the share of railways in freight traffic to 45 per cent by 2050.

expansion potential

The 2021 report by NITI Aayog and RMI India, on ‘Fast Tracking Freight in India – A Roadmap for Clean and Cost-Effective Freight Transportation’, said India’s freight composition is 70 per cent bulk and 30 per cent non-bulk.

Of the bulk, 40 percent is still transported by trucks (or road). Due to insufficient capacity, especially on some high-density routes, the railways have largely lagged behind the roads in the logistics sector.

“While there is immense potential for moving bulk goods from road to rail, low to medium value non-bulk products can also be moved by rail using intermodal transport,” the report said.

It also pointed out that in the US – which provides a fair geographic comparison to India – 66 per cent of non-bulk freight moves by road, with 30 per cent carried by rail or rail-intermodal. This is much less than 92 per cent of the non-bulk freight carried by trucks in India.

Padmanabhan said other modes of transport, especially roads, are capable of providing significant flexibility to transporters as well as end-to-end service and on-demand service.

For railways to grow as a freight service, he said, it is important that they provide required wagons on demand and also provide time-table-based service.

Banerjee said, “In railway transport, since a single line serves passengers as well as goods, priority is given to passenger trains over freight locomotives, which adds to the issue of timely freight transport.

“In addition, some routes on the network are operating at more than 100 percent capacity, which is straining and slowing down the network.”

Once the Dedicated Freight Corridor (DFC) becomes fully operational, he said, it is expected to be a game-changer in the Indian logistics industry.

“Setting up of DFCs will help in decongesting the saturated rail and road network and encourage shifting of freight traffic from existing road and rail networks to more efficient DFCs,” he added. Capacities on the existing rail network enable it to meet the freight demand for additional goods as well as mass passenger trains.

(Editing by Sunanda Ranjan)

Read also: Vande Bharat Express is changing Indian Railways. Now Indians need to do their bit