Union Finance Minister Nirmala Sitharaman with Minister of State for Finance Pankaj Chowdhary addresses a press conference in Mumbai on February 4, 2023. , Photo Credit: PTI

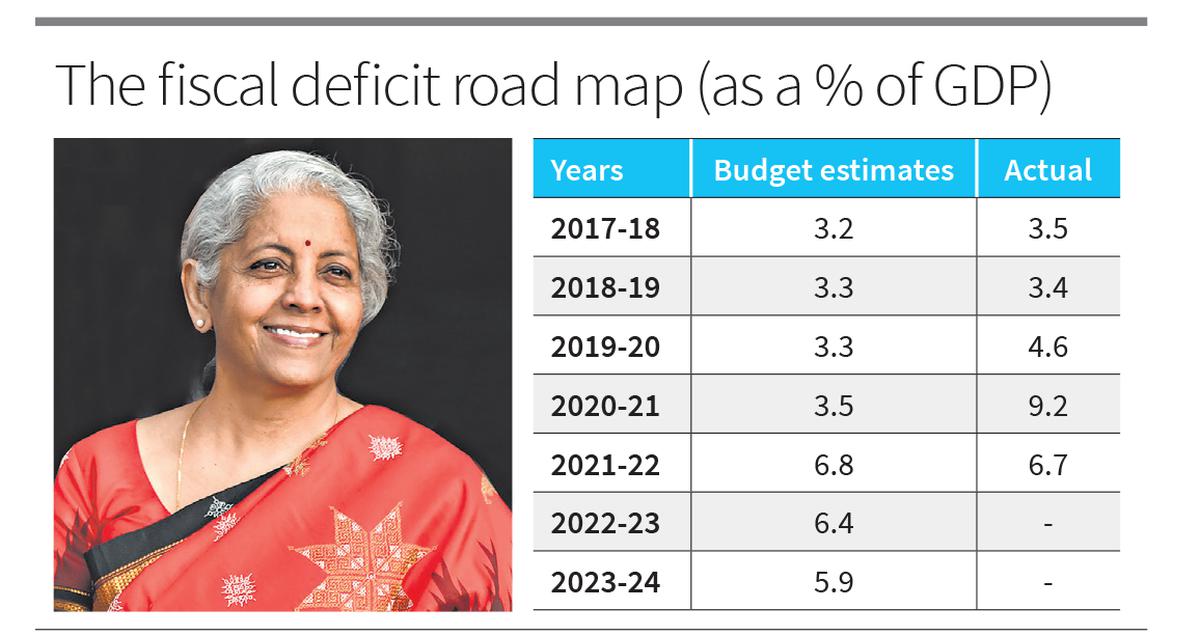

the story So Far: In Union Budget for 2023-24, Finance Minister Nirmala Sitharaman chose the path of relative fiscal prudence and projected a decline in the fiscal deficit to 5.9% of gross domestic product (GDP) in FY2024 from 6.4% in FY2023. Ms. Sitharaman said that the government plans to proceed on the path of fiscal consolidation To reduce fiscal deficit to below 4.5% by 2025-26, To finance the fiscal deficit in 2023-24, she said net market borrowing from dated securities is estimated at ₹11.8 lakh crore, and the remaining financing is expected to come from small savings and other sources. Gross Market Borrowings Estimated at ₹15.4 lakh crore.

What is the direction given on the fiscal deficit in the budget?

In the Union Budget 2023-24, the fiscal deficit has been pegged at 5.9% of GDP in FY24. This ratio has come down to 6.4% in 2022-23 (revised estimate) and 6.7% in 2021-22 (actual).

The deficit in the revenue budget was 4.1% of GDP in 2022-23 (Revised Estimates). In the Union Budget 2023-24, the revenue deficit is 2.9% of GDP. If the interest payment is deducted from the fiscal deficit, called the primary deficit, it was 3% of GDP in 2022-23 (RE).

The primary deficit, which reflects the current fiscal stance net of past interest payment liabilities, has been pegged at 2.3% of GDP in the Union Budget 2023-24.

Is the allocation low for some sectors?

The major allocations that have been reduced are food, fertilizer and petroleum subsidies. The food subsidy was ₹2,87,194 crore in 2022-23 (Revised Estimates). It has been reduced to Rs 1,97,350 crore in 2023-24. Similarly, the fertilizer subsidy was ₹2,25,220 crore (RE) in 2022-23; For FY24 it has been reduced to 1,75,100 crores. Petroleum subsidy was ₹9,171 crore (RE) in 2022-23; This has come down to ₹2,257 crore in 2023-24 (Budget Estimates/Budget Estimates). However, it is to be noted that the decline is not as sharp as compared to BE 2022-23. Food subsidy in BE 2022-23 was ₹2,06,831 crore; The fertilizer subsidy was ₹1,05,222 crore, less than the amount allocated in the Budget Estimates 2023-24. It is a laudable decision to provide food security to the poor for one more year amid rising inflation. However, rationalization of subsidies is important so that the government moves towards reaching the fiscal deficit target of 4.5% by 2025-26.

What needs to be done for growth?

Inflation troubles the poor. Given the supply-side shocks, interest rate management by the RBI through inflation targeting alone may not effectively control inflation. Therefore, fiscal policy measures are important to combat rising inflation. Policy coordination between the RBI and North Block is critical for the sustained growth recovery process. RBI is increasing policy rates to deal with rising inflation. But a high interest rate regime can harm the economic growth process. Therefore, fiscal policy needs to remain “accommodative” with a focus on gross capital formation in the economy, which includes increasing capital expenditure, especially infrastructure investment. In the 23-24 budget, capital expenditure is expected to rise to 3.3% of GDP. Interest-free loan of ₹1.3 lakh crore for 50 years provided to states should help them spend and boost growth.

Read this also | Fiscal deficit touches nearly 60% of full-year target at end-December

Ms. Sitharaman asserted that investment in infrastructure has a massive multiplier effect on economic growth and employment.

Government can. Stick to fiscal consolidation?

The government has not deviated from the path of fiscal consolidation. In the Union Budget 2023, the medium-term fiscal consolidation framework states that the fiscal deficit-GDP ratio needs to be brought down to 4.5% by 2025-26 from the current 6.4%. There are revenue uncertainties in the post-pandemic period as well as geopolitical risks, rising inflation, supply chain disruptions and energy price volatility. At the same time, the government has kept fiscal policy “accommodative”, and made capital expenditure to support the economic growth recovery. The major method of financing fiscal deficit in India is through internal market borrowings. It is also to be financed through securities against small savings, provident funds and an insignificant component of external debt. In the Union Budget 2023, India’s external debt has been pegged at Rs 22,118 crore of the total fiscal deficit of Rs 17,86,816 crore in 2023-24 (BE), which is about 1%. In the Union Budget 2023, it has also been said that states will have to maintain a fiscal deficit of 3.5% of GSDP, of which 0.5% will be linked to power sector reforms.

What are the rating agencies saying?

Taking advantage of buoyant revenues, the government plans to significantly increase spending on infrastructure while cutting personal income taxes, and providing capital support for the oil sector, according to Moody’s. The budget plans are debt positive for renewable energy companies, cement and steel producers, oil marketing companies and especially vehicle manufacturers.

While continued gradual fiscal consolidation contributes to the stabilization of the government’s debt burden and supports credit quality, its ambitious target of limiting the deficit to 4.5% of GDP by FY26 is unlikely to be achieved, Moody’s said. According to Fitch Ratings, the slow fiscal consolidation process in the wake of the pandemic could leave public finances exposed to major economic shocks ahead.

what lies ahead?

The Finance Minister is focusing on improving economic growth through capital expenditure. He says that investment in infrastructure will encourage private investment. In the fiscal deficit-GDP ratio, if the divisor GDP expands, it will reduce the overall fiscal deficit-GDP ratio. His focus is on economic growth recovery to strengthen GDP.

Lekha Chakraborty is Professor NIPFP and Member, Board of Management, International Institute of Public Finance (IIPF), Munich