Kerala’s public debt nearly doubled in the last seven years to reach ₹3,32,291 crore in March 2022

Kerala’s public debt nearly doubled in the last seven years to reach ₹3,32,291 crore in March 2022

the story So Far: In the last few months, of Kerala Rising debt liabilities have been increasingly brought into focus with the Reserve Bank of India, the Comptroller and Auditor General (CAG) and the opposition Congress-led United Democratic Front (UDF) flagging the issue.

Kerala Infrastructure Investment Fund Board (KIIFB)

A body corporate constituted by the Government of Kerala to mobilize financial resources outside the state’s revenue for the development of the state’s infrastructure

Kerala Social Security Pension Limited (KSSPL)

A state government institution for seamless distribution of social security pensions by raising money from the open financial market and separating pension payments from the state treasury

Kerala recently highlighted the state’s financial position Finance Minister KN Balagopal in his sharp reaction against the central financial policies: Fiscal deficit subsidy cut by ₹7,000 crore; discontinuing Goods and Services Tax (GST) compensation of about ₹12,000 crore; and a proposed move to consider “off-budget” borrowings from state government entities such as the Kerala Infrastructure Investment Fund Board (KIIFB) and Kerala Social Security Pension Limited (KSSPL) as part of the state debt while fixing the state’s net borrowing limit. In form of .

Read also: The poor state of India’s fiscal federalism

Here are the details of the public debt position of Kerala:

What is the public debt position of Kerala?

In June, the state government informed the state assembly that the state’s cumulative debt as of March 2022 stood at ₹3,32,291 crore. This is a huge jump from ₹1,89,768.55 crore in 2016-17. And as per the CAG, the ratio of public debt to Gross State Domestic Product (GSDP) has increased from 20.43% in 2019-20 to 27.07% in 2020-21.

Why is the Debt-GDP/GSDP Ratio important?

It compares the government’s public debt to its gross domestic product (GDP). By comparing a country (or a state) with its output, the debt-to-GDP ratio indicates its ability to pay off its debts.

In recent years, there has been a huge increase in revenue expenditure in the state finances, rising from ₹91,096.31 crore in 2016-17 to ₹1,23,446.33 crore in 2020-21. Committed expenditure on interest payment, salary, pension etc. forms a significant part of this expenditure.

What is the CAG’s latest assessment of Kerala’s finances?

Adding to the debate is the concerns around ‘off-budget’ lending by state government instruments such as the Kerala Infrastructure Investment Fund Board (KIIFB). photo credit: mahinsha sa

In the latest audit report on state finances, CAG advises states to closely monitor debt stability And make a ‘serious effort’ to maintain a healthy debt-GSDP ratio. Free market debt accounts for 54 per cent of the state’s total financial liabilities. The government’s committed liability as a percentage of revenue expenditure increased from 61.22 per cent in 2016-17 to 68.01 per cent in 2019-20.

Read also:explained | What is KIIFB and what is its role in the development of the state?

The CAG has also taken note of off-budget borrowings made through KIIFB and KSSPL, whose combined outstanding liabilities as on March 31, 2021 amount to ₹16,469.05 crore. KSSPL’s outstanding liabilities of ₹10,848.61 crore constitute 65.87% of the total outstanding off-budget borrowings. , During 2020-21 alone, Kerala resorted to off-budget borrowings of ₹9,273.24 crore. The CAG observed that they would “have the effect of increasing the liabilities of the state government, leading to a debt trap over time”.

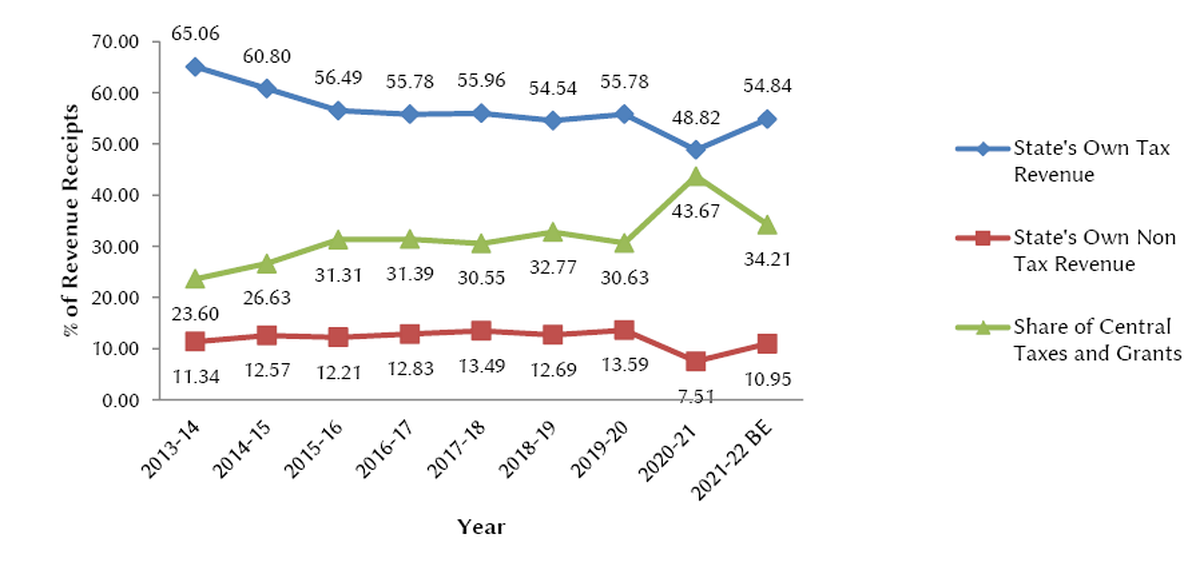

The CAG further said that the government should focus on the growth of its own tax revenue and take measures to improve it. The revenue receipts of the state increased from ₹75,611.72 crore in 2016-17 to ₹97,616.83 crore in 2020-21, registering a growth of 29.10%. However, the state’s own tax revenue, the main source of revenue in revenue receipts, grew only 13% and its share in the state’s revenue declined from 55.78% in 2016-17 to 48.82 in 2020-21. this indicates Poor collection of tax revenue during 2020-21, when the COVID-19 pandemic gripped Kerala.

Graph showing the percentage share of various sources in the revenue receipts of the state. Source: Kerala State Planning Board, Economic Review 2021

What is RBI’s analysis?

In June this year, a Reserve Bank of India (RBI) article, ‘State Finance: A Risk Analysis’, prepared against the backdrop of the Sri Lankan crisis, drew attention to the financial health of states with high public debt . , Kerala was identified as one of the ten states with the highest debt burden on the basis of debt-GSDP ratio.

Out of ten, Kerala ranked one in the sub-set identified as ‘highly stressed’. The RBI article said that states’ own tax revenues, including Kerala, have declined, leaving them vulnerable.

Kerala is also among three states where the debt-GSDP ratio is projected to exceed 35% by 2026-27, a situation that requires ‘significant corrective steps’ to stabilize debt levels, according to the RBI.

What is the position of the state government?

Finance Minister KN Balagopal (second from right) at the Kerala State Cashew Development Corporation factory at Ayathil in Kollam district. photo credit: special arrangement

Kerala Finance Minister KN Balagopal, while responding to the warning of a ‘debt trap’, had said that the state is indeed going through a crisis, but there is no danger of it falling into the debt trap. He has also been critical of the Centre’s stand that off-budget borrowing should be treated as part of state debt, and is reflected in the net borrowing limit.

Read also:New credit limit norms affect states’ borrowing plans

Kerala has repeatedly blamed central policies for most of its current financial problems, particularly the fall in its tax share from the Center and the discontinuation of Goods and Services Tax (GST) compensation beyond June 2022.

Also, the state has initiated efforts to increase tax collection. Last week, the cabinet approved a comprehensive Reforms in State GST DepartmentA move which is expected to have a positive impact on growth in tax revenue.

What is the way forward?

Experts recommend a lean strategy for the state at this juncture, keeping revenue expenditure low while increasing tax collections. The state would also need to make serious efforts to stabilize debt levels, a move that the RBI had also recommended as a medium-term corrective measure for debt-burdened states.

However, in the long term, both Mr. Balagopal and his predecessor, Dr. Thomas Isaacs understand that the state will have to increase its industrial production. What Kerala needs to do is accelerate growth, harness the potential offered by the knowledge economy to create jobs and boost the manufacturing sector. Shri Balagopal gave his opinion before presenting this year’s budget,

Incidentally, Kerala has improved its ranking in the Ease of Doing Business (EODB) index, a ranking of states and union territories based on business environment, jumping from 28th position in 2019 to 15th position in the World Bank. is the initiative. Also, as per the State Industries Department, Kerala is Beating its 2022 target of registering 1,00,000 Micro, Small and Medium Enterprises (MSMEs) with over 42,000 units Registered during the first quarter of the current financial year. Law, Industry and Coir Minister P. Rajeev has informed that the government has increased its target from 1 lakh to 1 lakh. 1.5 lakh MSMEs by the end of 2022-23,