representative image.

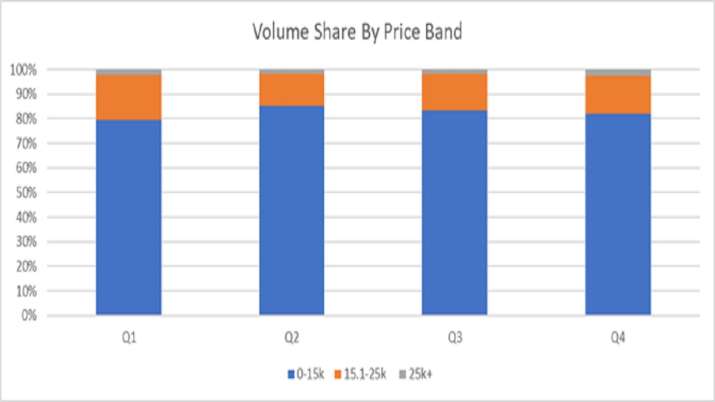

The second pandemic wave in the second quarter of 2021 (April-June 2021) and the growing popularity of online retail dealt a double blow to offline smartphone retail in 2021. While metros recovered sharply from the second pandemic wave, Q4 (January-March) sales outperformed sales in Q4. (October-December), both in value and volume, Tier 2 and 3 cities lagged behind. More smartphone users bought devices in the sub 15K price category, with the 25K category failing to grow. Vivo, after Xiaomi, was the top brand in terms of price and volume at the MBO across India. These and other information were released by PredictiVu, a data analytics firm that tracks the offline smartphone market across 50 cities in India in its annual MBO Smartphone India Overview Report 2021. The annual report tracks offline smartphone retail across the top 50 cities in India. January to December 2021.

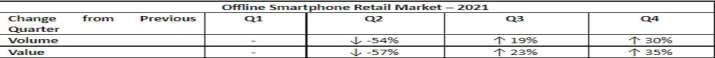

Offline smartphone retail sales fell 54% in the second quarter, rising 19% and 30% in Q3 and Q4, respectively, as a result of restrictions due to the pandemic. However, Q4 2021 remained 28% lower than Q1 volume. Similarly, offline retail prices fell 57% in Q2, recovering 23% and 35% in Q3 (July-September) and Q4. But the last quarter of 2021 ended 28% down from Q1 in value terms.

Offline Smartphone Retail Market – 2021.

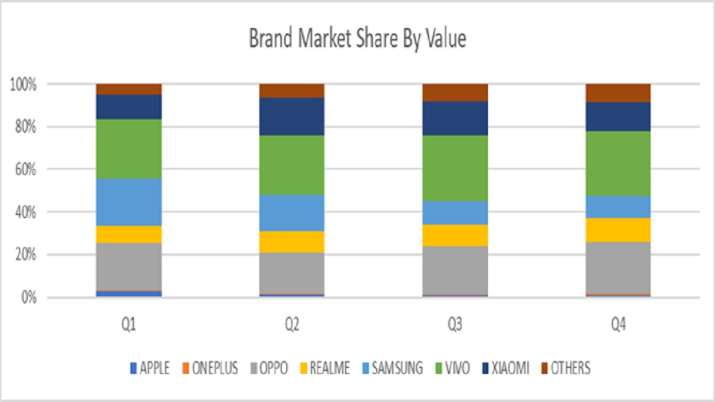

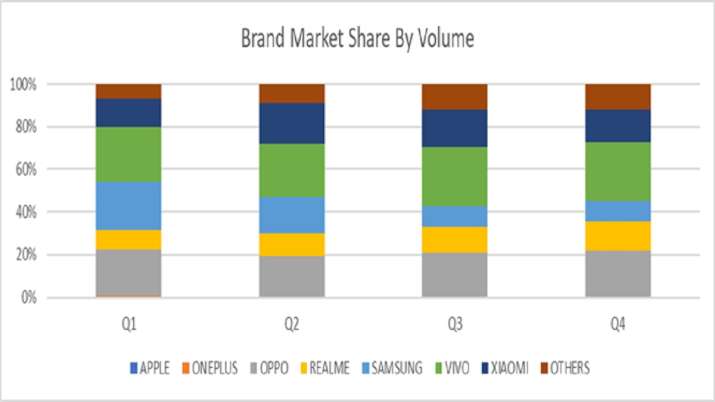

Among smartphone brands, Vivo continued to lead offline smartphone retail at multi-brand outlets, accounting for 29% by value and 27% in volume. Oppo took the second spot by volume with a share of 21%. This was followed by a tie for third place between Samsung and Xiaomi, both with a volume of 16%.

Samsung’s sales share in MBO continued to decline over the quarters, from 22% in Q1 to 10% in Q4. Apple decreased by 15% in Q4 as compared to Q1 by volume and 21% by value, while Oppo gained close to 20% during the same period in the 25k+ smartphone category.

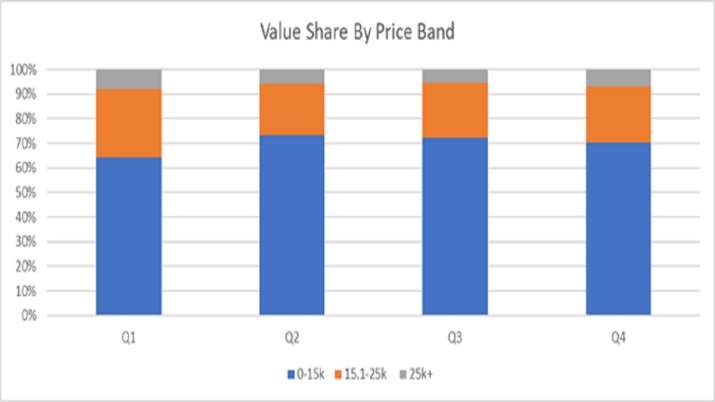

The market share for the North in Q4 grew by 15% compared to Q1 within the premium category of smartphones, while the West and South saw a decline for the same period. The major town classes were a major contributor to this change in shares. Although there is not much change for the large city category cities in terms of volume, the market share in terms of value has increased by 3%. This can be attributed to choosing a more expensive smartphone.

Talking about PredictiVu’s MBO Smartphone India Overview Report 2021, Kunal Sarkar, Vice President, PredictiVu said, “2021 has been a tough year for offline smartphone retail in India. As a result of the pandemic and the second wave, more people shopped online, making it difficult for offline retailers to thrive or survive. Many retailers in the MBO category have closed shutters permanently or are out of business for a long period of time. While the festive season brought hope in Q3 and Q4, significant recovery across India remains a challenge. However, metro cities did well with a jump in sales and outperformed the pre-second wave numbers. With Omicron-led sanctions continuing to pressure an already weak market, the first quarter of 2022 will reflect what the real impact has been.”

Rajesh Kurup, member of the Strategic Advisory Board, Predictiveoo, said: “2021 was expected to be a recovery year for offline smartphone retail, with Q1 sales being the highest among all quarters. However, the second wave played a bad game. An interesting trend we observed in all four quarters was the steady increase in the market share of smaller players in the offline smartphone retail market. This shows that with rising prices and declining income, smartphone users are turning to pocket-friendly smartphones. All this is also evident with the increasing popularity of smartphones in the 15K category.”

PredictiVu Insights | MBO Smartphone Brand Performance by Price and Quantity

PredictiVu Insights| MBO smartphone brand performance by price and quantity.

PredictiVu Insights| MBO smartphone brand performance by price and quantity.

PredictiVu Insights| MBO: Price Range Display by Price and Quantity

PredictiVu Insights | MBO: Price Range Display by Price and Quantity

PredictiVu Insights | MBO: Price Range Display by Price and Quantity

read also , FM Sitharaman highlights 7 engines to drive PM Gati Shakti

Read also | Banning Cryptocurrency is probably the best option for India: RBI Deputy Governor

,