Form of words:

New DelhiThe COVID-19 pandemic may have derailed the Indian economy, but it has certainly rocked the country’s stock markets.

There has been a huge jump in retail investors since the lockdown came into force in March 2020.common man‘ of the stock market. Around 10.7 million new demat accounts (for trading) opened in the COVID-dead year – approx. double What was the average trend over the last three years.

Amid concerns over such rapid growth in retail trade, a study by the economics team of the National Stock Exchange (NSE) offers important insights. Topic Market Concentration and Retail Investment in India, Study conducted by Tirthankar Patnaik, Chief Economist of NSE, was published In the October issue of the monthly publication of the Exchange market pulse,

According to the study, not only have retail investors grown in size, but they are also investing in top-value stocks, and have the most diverse bouquet of stocks in their portfolios compared to institutions.

Read also: IPO frenzy prompts SEBI to propose stricter listing rules on exit from investors, raising cash

net buyer

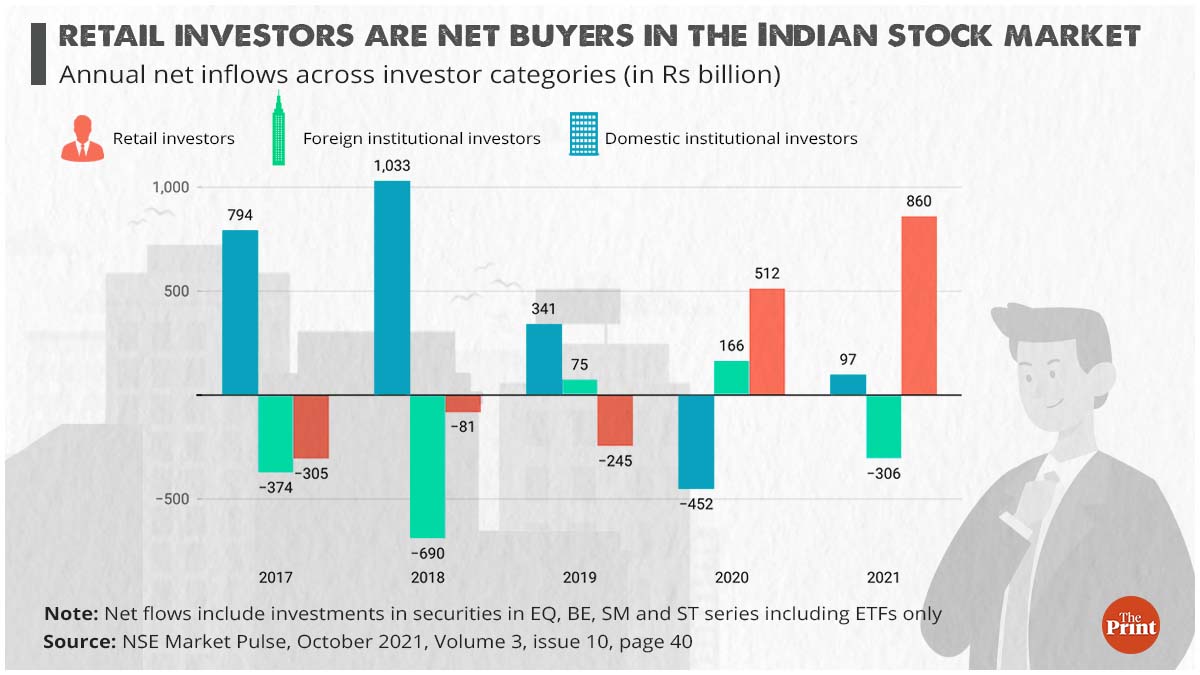

Before the pandemic, retail investors were net sellers of stocks, meaning they pulled out more money than they put in. However, 2020 changed that as Covid-19 prompted people to park surplus money in the stock markets.

The study divides investors into three broad categories – foreign institutional investors or FIIs (foreign companies investing in Indian stocks), domestic institutional investors or DIIs (Indian organizations investing in stocks) and retail investors (individuals). Promoters , Indian, foreign and government There are other types of equity investors, which were outside the scope of the study.

The study shows that retail investors were net sellers of stocks till 2019. In 2017, the net outflow of these investors stood at Rs 30,500 crore. The number fell to Rs 8,100 crore the following year, but rose again to Rs 24,500 crore in 2019.

In 2020, there was a reversal in the trend as more number of individuals bought more than they sold – hence, net inflow of Rs 51,200 crore. And by the third quarter of calendar year 2021, the net inflows from retail investors rose to Rs 86,000 crore.

In comparison, the net inflow from DII was just Rs 9,700 crore in the same period.

Read also: WPI inflation hits 5-month high of 12.54% in October

Larger and more diversified stock, smaller quantity

The study shows that spending by retail investors is also much more diverse than that of institutions.

FIIs spent in less stock and limited activities. By comparison, domestic institutions had more in their bouquet, taking advantage of their “geographical familiarity”. But retail investors went a step further and had the most diversified portfolio, investing in 1,900 stocks.

His investment comes even as the market density (investment in low and large stocks) increased during the Covid crisis.

“Consistent with what we saw on the overall concentration in July 2020, there has been a clear, moderate increase across all three portfolios since mid-2017, largely due to the general risk-off sentiment arising from a multi-year macro downcycle, which business scuttled. Large-cap stocks,” says the study.

Despite this, domestic institutions and retail investors are still expanding their portfolios into diversified stocks. However, after July 2021, FIIs are limiting themselves from expanding, which is why their concentration levels have increased, it adds.

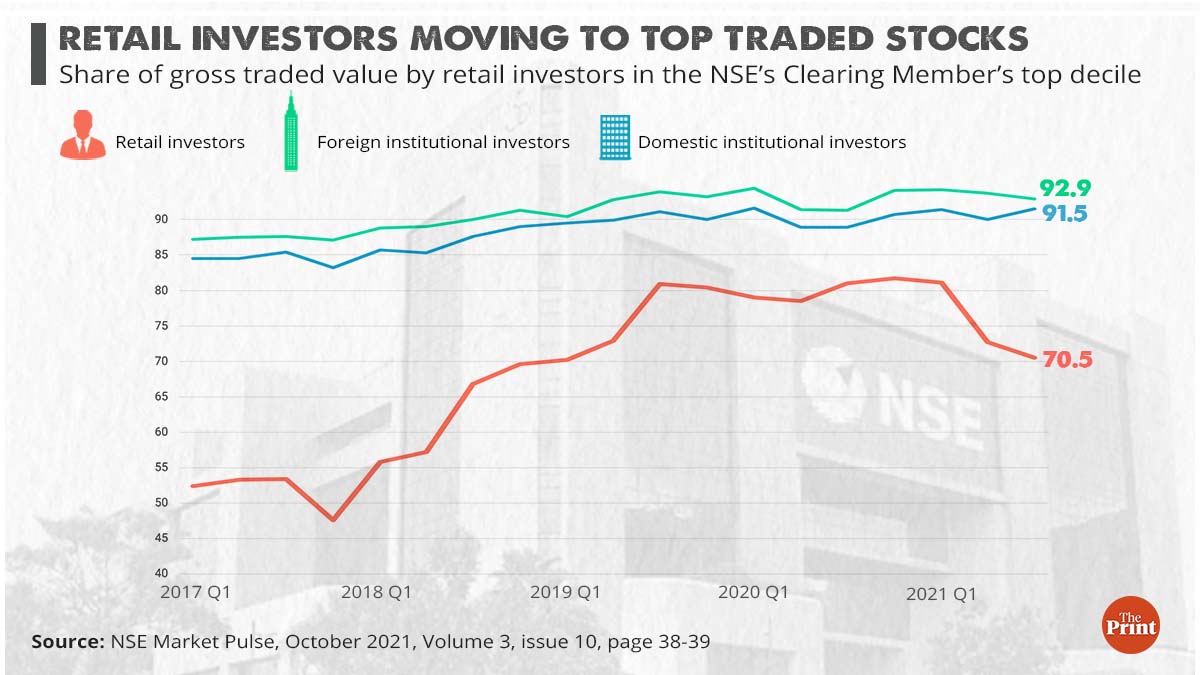

Another interesting insight from the study is that individual investors are now more interested in trading with the highest priced stocks.

FIIs and DIIs usually make large investments in high value stocks. However, retail investors have also been climbing the ladder since 2017.

In the first quarter of 2017, the share of the top decile’s retail trading value was approximately 52.4 percent of the gross value traded by retail investors, rising to 81.7 percent at its peak in the last quarter of the previous year. The holding of such shares stood at 70.5 per cent at the end of the third quarter of the calendar year 2021.

Speaking to ThePrint, Patnaik said his study shows that “the portfolio was turning cautious (overweight for large-cap stocks) over the years”.

“Such behavior would have a tendency to alert, ceteris paribus, Since the second quarter of 2021, retail investors have noticed a wider universe of opportunities, and this was in line with institutional investors. Both FIIs and DIIs in search of alpha added new stocks to their portfolios,” Patnaik said.

However, the report also noted that despite investments in top-value stocks, the average holding of retail investors is small. The study shows that nearly 80 per cent of the 19 million retail investors had an average investment of less than Rs 50,000.

This likely suggests that retail investors held just 9.4 per cent of NSE-listed stocks in September 2021, while DIIs held 13.4 per cent and FIIs held 21 per cent.

Terms and Conditions applicable for FDs and Gold Lovers

The rise of retail investors is also linked to traditional investment options like fixed deposits (FDs) and gold is becoming less attractive compared to the returns that the stock markets can provide.

“The net inflows over the last two years can be attributed to increased interest by retail investors, who stayed or worked from home during the COVID-19 pandemic, from the gradual fall in real interest rates to higher-yield investment avenues. Change in investment. Easing monetary policy environment with high inflation,” said the study.

Trending also comes with a lot of uncertainty, as stocks are subject to market risks.

“What happened during Covid was that the salaried people were left with more disposable income due to non-movement. They had more time and money to invest – and in some cases, they took huge risks, i.e., investing without proper research or leverage,” said Aditya Kondavar, chief operating officer of JST Investments, a Mumbai-based company.

“The dissemination of financial market information has also made it easier for people to create informative videos/tweets/articles as recommendations. In some cases, they are literally taking quick advice from Twitter,” Kondavar said.

“But there is no free lunch in the market, and therefore every investor should research and only then invest/decide,” he warned. “People are subscribing to the IPO as if it is a lottery ticket. A company that wants to raise Rs 500 crores ends up raising Rs 1-2 lakh crores and that certainly shows enthusiasm.

Patnaik also said that this growth in retail investors needs to coincide with the increase in information flow for stability.

“Improving investor awareness and knowledge is the key to getting these investors into the markets on a sustainable basis, as they view equities favorably as an asset class,” he said.

(Edited by Amit Upadhyay)

Read also: India plans forward-looking measures on crypto-related issues

subscribe our channel youtube And Wire

Why is the news media in crisis and how can you fix it?

India needs free, unbiased, non-hyphenated and questionable journalism even more as it is facing many crises.

But the news media itself is in trouble. There have been brutal layoffs and pay-cuts. The best of journalism is shrinking, crude prime-time spectacle.

ThePrint has the best young journalists, columnists and editors to work for it. Smart and thinking people like you will have to pay a price to maintain this quality of journalism. Whether you live in India or abroad, you can Here,