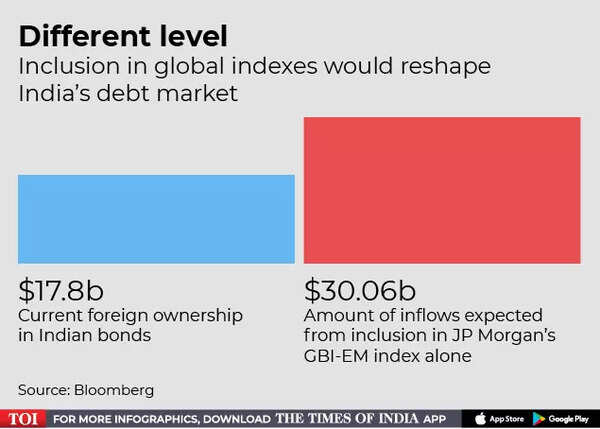

Morgan Stanley expects an announcement that India will be included in JPMorgan & Chase Co.’s emerging markets bond index in mid-September with an actual entry in the third quarter of next year. Goldman Sachs Group Inc. The announcement comes in the fourth quarter of this year and expects to join the second or third quarter of 2023. Both expect India to weigh 10%, the highest for any country in the index, and have a potential inflow of $30 billion. trick.

get higher yield Indian sovereign bond Joining the global index will make it easier for foreign investors to pump their money into Asia’s third-largest economy with a $1 trillion debt market. It would follow several false starts over the years, including one on tax breaks for foreigners as a result of warnings about debt flows and disagreements. Russia’s exclusion from JPMorgan’s projections after the invasion of Ukraine may have added to the incentive for index compilers to fill the hole with Indian debt.

JP Morgan, one of the leading index providers, is gathering feedback from investors to include India in its government bond index – Emerging Markets Global Diversified, or GBI-EM. A survey by Morgan Stanley has revealed that more than 60% of real money investors are ready or almost ready to join India. A spokesperson for JP Morgan in India declined to comment.

Nivedita Sunil, Portfolio Manager, Asia and EM Debt, said, “India will offer much needed diversification to the GBI-EM Index given the diverse structure of its economy, and hence will be a strong addition to the index from a long-term perspective.” At Lombard Odier (Singapore) Ltd “We have consulted with the index provider and we support it widely.”

Bond traders in India have had their hopes dashed on index inclusion in the past. There were widespread expectations in February that the government would announce a tax break for foreign investors in the budget that would facilitate trading of the country’s debt on platforms such as Euroclear.

Instead, the budget was silent on the issue. Officials have said they have decided not to exempt international bond transactions from taxes, and they want bonds to be settled locally.

Aninda Mitra, Head of Asia Macro and Investment Strategy at BNY Mellon Investment Management, said, “India is its own size and has the ability to act on its own.” “But it’s important to make a strategic decision and stick to it, rather than sending conflicting signals.”

Meanwhile, as Morgan Stanley notes, Russia weighed about 8% in the GBI-EM index before it was removed, and now has seven countries with a 10% weight and 13 countries sharing the remaining 30%.

“Russia’s exclusion has made the index more focused and unbalanced,” Morgan Stanley strategists Min Dai, Madan Reddy and Gek Teng Khu wrote in a note in early September. “So JP Morgan has more incentive to include India even without Euroclear, as long as GBI-EM investors don’t object.”

According to the bank, India is currently ‘on track’ on Index Watch for inclusion in JP Morgan’s bond index. It is also on FTSE Russell’s watch list for inclusion in its emerging market debt index.

Bloomberg LP is the parent company of Bloomberg Index Services Ltd., which manages competing indexes from other service providers.

Renewed market talk on index inclusion last month helped revive inflows into rupee-denominated bonds after six consecutive months of outflows. Foreign inflows will be crucial to meet the country’s ever-increasing bond supply as its funding needs expand. Yields are declining for the third month since June, with the benchmark 10-year bond yield falling more than 30 basis points.

The authorities have taken some steps to relax the rules for foreigners. Recent regulations such as allowing custodian banks to pre-fund trades on behalf of foreign investors and extended settlement times are examples, according to Goldman Sachs. Nevertheless, major issues remain.

“We think the two biggest operational challenges are account opening times and heavy trading requirements,” said Eric Low, fixed-income fund manager at Manulife Investment Management. He said opening a local Bharat Bond trading account may take up to nine months, but such operational constraints are not a “show stopper” for the firm to invest in the market.