Form of words:

Hong Kong: China’s crackdown on technology companies is prompting global investors to seek new opportunities across Asia, contributing to a record jump in initial public offerings from India to South Korea that shows some signs of slowing.

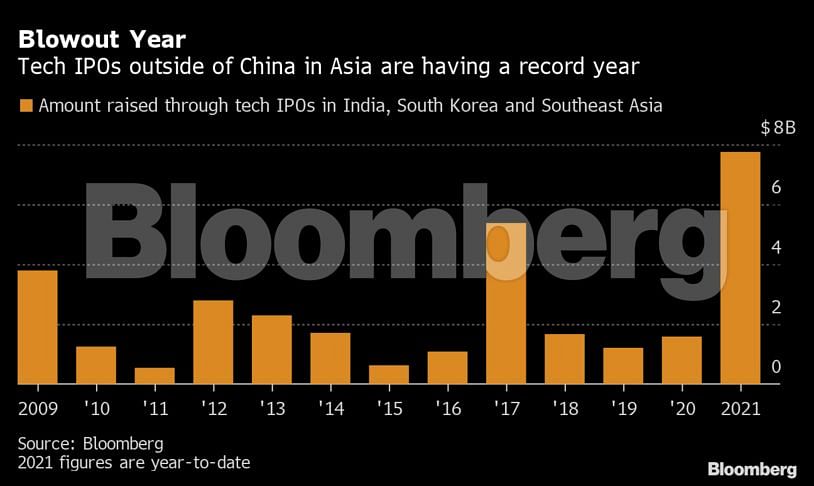

Tech companies in those two countries and Southeast Asia have raised $8 billion from share sales for the first time this year, already surpassing the previous annual peak. The tally is poised to get bigger with planned listings by companies including Indian fintech giant Paytm and Indonesian internet conglomerate Goto, both of which could be breaking local fundraising records.

Long overshadowed by their Chinese peers, this new crop of startups is coming of age, as Beijing’s clunky listings and growth prospects put a damper on what was long the region’s hottest IPO market. .

The new era of technical listing

The result, some bankers say, could be the beginning of a new era for tech listings in Asia. Investors are already increasing exposure to markets outside China, with some buying into IPOs from countries such as India and Indonesia for the first time. Potential issuers, which have historically benchmarked themselves against Chinese companies, are now uncovering similarities with other global peers in the hope of achieving higher valuations.

“These are strong companies and stories in their own right, but moving away from China’s technology has driven huge demand,” said Uday Furtado, co-head of Asia Equity Capital Markets at Citigroup Inc.

China’s regulatory onslaught has slashed the valuation of the country’s listed tech companies by nearly 40%, now in its 10th month since the shock of the Ant Group company’s IPO. It has also forced several startups to put their IPO plans on hold after regulators announced a stricter scrutiny process for overseas offerings.

China and Hong Kong accounted for nearly 60% of Asian tech IPOs since the end of June, down from 83% in the second quarter, according to data compiled by Bloomberg. Nearly three quarters of Chinese companies that listed overseas this year are now trading below their IPO prices.

Meanwhile, deals in smaller markets are attracting outside demand as investors bet on an increasingly Internet-savvy population, rising consumer spending and a new class of tech entrepreneurs.

Indonesian e-commerce firm PT Bukalpak.com has raised $1.5 billion in the country’s biggest ever IPO by the end of July, well above its initial target of $300 million to $500 million.

Zomato Ltd., an Indian online food-delivery and restaurant platform. received a bid of 1.5 trillion rupees ($20.2 billion) from the larger fund for its anchor tranche, making it one of the most popular Indian offerings among institutional investors. The company raised $1.3 billion in July.

Kakaobank Corp., South Korea’s first Internet-only lender to go public, sold $2.2 billion worth of new shares last month and rose more than 70% at the start of its trading.

“The hurdle in allocating capital to tech companies in China is now much higher than it was a month ago,” said Vikas Prasad, portfolio manager, M&G Investments (Singapore) Pte. “The net exposure to China technology is low and the net risk to technology-driven business models outside of China is high.”

Read also: Biden criticizes China for not assisting US probe into origins of COVID-19

A banker who asked anonymity to discuss customer information said some Hong Kong investors who previously focused on Chinese deals are now participating in tech IPOs elsewhere in the region. Another banker said that US hedge funds are also watching India closely. Morgan Stanley Research analysts recently advised clients to rebalance their Internet holdings in India and Southeast Asia away from China.

“Are investors more interested? Certainly,” said William Smiley, co-head of Asia’s ex-Japan equity capital markets at Goldman Sachs Group Inc. “Global capital competes among themselves and investment opportunities are evaluated on both an absolute and relative basis.”

Whether the enthusiasm will continue is an open question. Bukalapak.com briefly fell below its offering price this month, though the stock has bounced back. Zomato and KakaoBank are trading 64% and 115% above their IPO prices, respectively.

The growing pipeline of deals will put investor demand to the test. Paytm – formally called One97 Communications Ltd – has filed for an IPO of Rs 166 billion, which is India’s biggest IPO ever. Policybazaar, an online insurance marketplace, is planning to raise up to Rs 60.18 billion.

Goto, formed by the merger of Indonesian ride-hailing giant Gojek and e-commerce provider PT Tokopedia, is planning a domestic IPO this year before seeking a US listing. It is currently raising funds at a valuation of between $25 billion and $30 billion, which means it could become Indonesia’s biggest debut to date.

“Asia-based growth businesses have increasingly diverse sources of capital investment,” said Gregor Feige, ex-Japan co-head of ECM Asia at JPMorgan Chase & Co. “Sovereign wealth funds are more active across the board. They are leaning and the global longstanding community is also becoming increasingly comfortable with local listings across Asia.”

A flood of tech IPOs in Southeast Asia and India is set to reshape markets where benchmark indexes have historically focused on “old economy” sectors such as energy and finance.

“The favorable demographics and household consumption growth in Southeast Asia have not fully translated into stock market performance of late,” said Pauline Ng, portfolio manager at JPMorgan Asset Management, which did not list some of the fastest growing businesses. had gone.” The increasing representation of “new-economy” companies means that these markets “cannot be ignored anymore,” she said.—bloomberg

subscribe our channel youtube And Wire

Why is the news media in crisis and how can you fix it?

India needs free, unbiased, non-hyphenated and questionable journalism even more as it is facing many crises.

But the news media itself is in trouble. There have been brutal layoffs and pay-cuts. The best of journalism are shrinking, yielding to raw prime-time spectacle.

ThePrint has the best young journalists, columnists and editors to work for it. Smart and thinking people like you will have to pay the price for maintaining this quality of journalism. Whether you live in India or abroad, you can Here.